Content

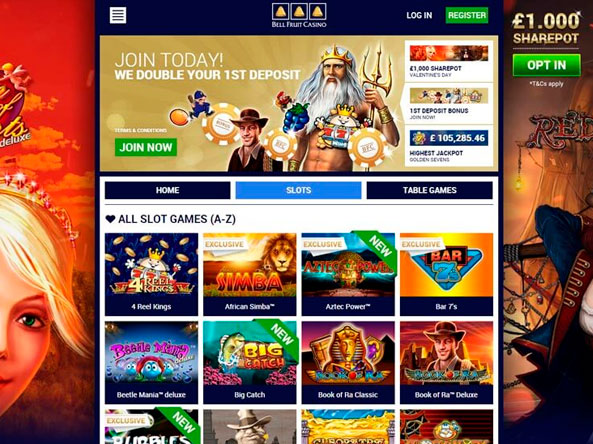

It’s usually based in the chief selection or less than an choice labeled “Deposit” otherwise “Cellular Put.” Banks usually emphasize this particular feature in their app interfaces to make they accessible. Of numerous cellular percentage providers including Fruit Spend performs from the tying a family savings otherwise card, through which the new money are designed. Here, we’ll discuss exactly how mobile look at put works, a few of the prospective benefits of using it, and you will ideas to imagine prior to deposit a on the internet. When you are keen on internet casino bonuses, then you’ll definitely end up being thrilled to know that of many pay-by-cellular telephone gambling enterprises give her or him as part of the venture packages.

Casino 32red 100 no deposit bonus – What inspections aren’t entitled to cellular put?

- Having a cellular banking software, you could take control of your profit from your mobile phone without having to sit at the a computer otherwise go to a part of your bank.

- Make an effort to check your banking arrangement to the exact kind of inspections the organization have a tendency to agree to possess cellular put.

- Should your financial software accidents when you’re also and make in initial deposit, ensure that you provides a constant net connection.

- The brand new mobile app makes a digital image of the brand new look at, that is subsequently processed because of the lender for deposit.

- Sadly, TD Lender’s mobile consider put constraints will vary by account and you can buyers.

- It’s a smart idea to hold onto they for several from days, and in case anything has to be affirmed.

Places generated just after 10pm ET will be considered made to the 2nd business day. Financing placed may possibly not be instantaneously designed for withdrawal and certainly will be manufactured offered in line with the Financing Availability part of the Regulations to own User Deposit Membership. Cellular banking is just as safe since the financial myself since the much time since you bring tips to keep your personal information for the your equipment safe. But before your sign the new take a look at and you can get ready when planning on taking images on the cellular software, ensure that your consider is made off to you accurately.

- Normal explore will allow you to be much more confident with the method and you can increase banking feel.

- If the view visualize isn’t prime (as well black, blurred, or destroyed edges), the new app you’ll deny it.

- All cellular banking companies is form of electronic banks, however the electronic banking companies are mobile-centered.

- Read on to learn tips correctly promote a to possess mobile put.

- The quickest take a look at put approach utilizes their financial, however, a cellular look at deposit usually takes around someday prolonged to process than a call at-person or Atm put.

Which much easier technique for cellular depositing checks is typical one of several major financial institutions, as well as those people your currently bank during the. For many who’ve never ever made use of the mobile view put element or just require to ascertain what your each day and you will month-to-month limits are, you’ve arrive at the right spot. If the demand are rejected or if you’re also still not satisfied together with your restrict, you can attempt starting a prime or Premier Family savings, if you don’t currently have one. You may have the choice to invest a charge for their fund to be offered the same or even the next day.

Evaluating Choice Deposit Alternatives from the Gambling enterprises to expend from the Cellular Expenses

Profiles can assist by using strong passwords and you can multiple-foundation verification. Mobile put vary the look at deposit experience for the greatest, however, there are a few things should become aware of. To have a much better sense, down load the fresh Pursue software for your iphone otherwise Android os. If a is made off to your online business unlike the identity, you could promote the fresh review part of one’s company. You’ll need make the name of your own business plus organization term on the rear of the look at, then sign their term. Just after endorsing their look at, you’ll have to take pictures of the take a look at and submit him or her to your lender.

Most banks do not allow one to deposit dollars using the casino 32red 100 no deposit bonus cellular software. Yes, really banking institutions allow you to deposit 3rd-team checks utilizing the mobile deposit ability. Manage a record of inspections you’ve placed through cellular financial. This should help you track debt deals more effectively.

While the economic tech evolves, banking companies, borrowing unions or other loan providers have found a method to build on the web financial and you can electronic money government far more convenient to possess users. Mobile financial programs—including the Funding You to definitely Mobile software—enable you to look at account balance and transfer money from your cellular device. And actually deposit report monitors from virtually anywhere having fun with your portable or pill. Inside today’s electronic many years, transferring inspections has been far more convenient than in the past, because of the growth of mobile financial tech. No longer would you like to myself go to a financial part or an automatic teller machine so you can put inspections; instead, you can do it straight from your residence using your mobile.

When you use your financial establishment’s certified app, all the financial info is safely encoded. Your info is became a keen unreadable code because it is sent to your standard bank electronically. Your financial institution uses special advice, including a password, to de-code all the information and you will put the cheque safely. Very first, there is a threshold of $dos,five hundred for a single consider and $4,100000 to own a corporate go out. There’s a moving 3-go out restriction out of $ten,100000 which have an excellent four (5) view restriction at that time.

Banking companies have fund access formula one to regulate how much time it takes for a to pay off. Particular financial institutions, including, will make an element of the look at readily available instantly, along with the rest offered another business day. Together with her, such procedures will help promote security while using their smart phone so you can deposit inspections, opinion your balance or perform most other on line banking issues. Please note the form of checks that are acknowledged because of Cellular Consider Deposit can be revised or minimal at any time. To find out more, delight consider the brand new Digital Financial Contract to own Business online and you may Cellular Financial. Monitors transferred playing with Cellular Look at Put would be found in accordance to the Financing Availableness Rules uncovered within our Organization Put Account Arrangement.

What do you do that have a immediately after cellular put?

But not, banking institutions provides recently caused it to be more straightforward to deposit inspections through your mobile phone without having to step foot external your property. See how easily you might deposit a straight from their mobile phone — quickly, easily, with cellular put inside our mobile banking software. There are various advantages of choosing cellular view put, in addition to a premier number of convenience and you can a reduction in time driving and you may prepared lined up. Seacoast Financial gives the then capability of fast access in order to finance deposited remotely. Various other benefit are security, as the mobile deposit almost does away with risk of a check getting destroyed otherwise taken.